How the One Big Beautiful Bill may impact your healthcare

and what you can do now to prepare for those changes

The One Big Beautiful Bill Act, signed into law by President Trump on July 4, 2025, represents the largest cuts to Medicaid in history and will have profound immediate and long-term effects on ACA Marketplace health insurance, Medicare, and Medicaid. The Congressional Budget Office estimates that 16 million more Americans will become uninsured by 2034, marking what experts describe as the “the biggest roll back of health insurance coverage ever due to federal policy changes.”

This bill’s effects will unfold over nearly a decade, fundamentally reshaping our healthcare landscape through reduced coverage, increased cost, and system-wide financial pressure that will particularly impact vulnerable populations and rural communities.

Immediate Effects (2025-2027)

ACA Marketplace Changes

The bill introduces a few big restrictions for those covered by insurance purchased on the Marketplace. These include

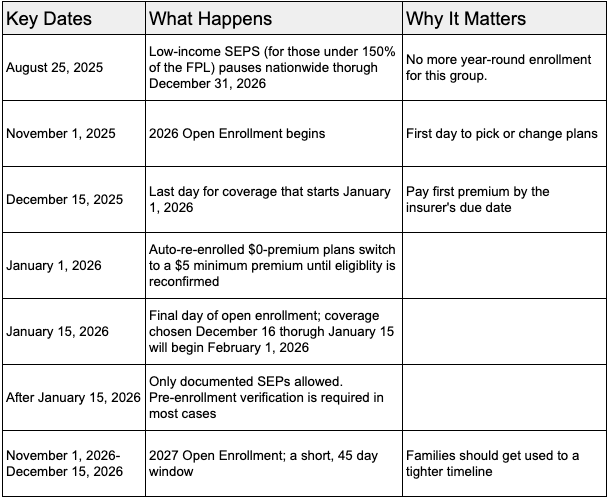

- Shortening enrollment periods to just 45 days from the current 75-day minimum. This change takes effect for plans that start in 2027. Starting in 2026, the open enrollment period will still start on November 1, but instead of ending on January 15, it will end on December 15. For states that do not use the Federal Marketplace and instead have a state-based exchange, their enrollment window cannot be longer than 9 weeks.

- Enrollment restrictions for those with low-income special enrolment periods. Previously, under the America Rescue Plan, if you earned less than 150% of the federal poverty level, you were eligible for year-round enrollment in a $0 benchmark plan. Under the new law, individuals need to use the Open Enrollment period or utilize a different SEP.

- Eliminating eligibility for DACA recipients. Those covered under DACA became first eligible for ACA coverage in November, 2024. The new law will disenroll these individuals on August 25, 2025.

- Elimination of Enhanced Premium Tax Credits. Starting at the end of 2025, the EPTC that made coverage more affordable since 2021 will be eliminated, causing out-of-pocket cost to increase by over 75% on average and monthly premiums to increase by 15% for 2026 coverage.

- New documentation requirements to verify income. Currently, if your income changes when you change or lose a job, resulting in a PTC or CSR, you are required to provide proof of this change within a window of a few months. Under the new law, this window is shortened and additional documentation is now required if the change in income breaks a certain threshold. This change is particularly difficult as many times, with a new job, you don’t always have pay stubs right away.

- Pre-enrollment verification requirements. The new law requires that income, immigration status, health coverage status, place of residence, and family size all be verified before coverage. You can still enroll in a plan without this verification, but the full-price premium will need to be paid and any APTCs or CSRs will not be issued until the verification has gone through.

- Repayment of excess tax credits. If you underestimate your income and receive a subsidy that is greater than what you should have received based on your actual income, you are required to pay this back. Currently, there is a cap to what you need to repay. Under the new law, this cap has been removed. Additionally, repayment must be made before receiving any subsidies for the following year. This means that not filing taxes (or postponing filing) will result in a loss of APTCs for the next year.

Changes to Medicaid

Most of the changes to Medicaid are being delayed until after the midterm elections in 2026, but states need to begin preparing for these changes immediately. Over $715 billion in Medicaid cuts have been made. The major changes include:

- Work requirements. Starting December 2026, all adults age 19-64 are required to work a minimum of 80 hours per month to remain eligible for Medicaid benefits.

- Increased cost-sharing. Starting October 2028, states are now required to impose a $35 charge per service for all services covered under Medicaid.

- Increased eligibility reviews. Starting December 2026, states must conduct reviews every 6 months, instead of annually.

Changes to Medicare

A temporary 2.5% increase in payments was approved for 2026. However, this comes with the trade off of automatically triggering $500 billion in Medicare cuts over the next 8 years.

Long-Term Effects (2027-2034)

ACA Marketplace Deterioration

The long-term outlook for ACA Marketplaces is concerning. The factors mentioned above contribute to what experts warn could be an “adverse selection death spiral.” The combination of higher premiums, reduced enrollment periods, and elimination of enhanced subsidies is expected to drive away healthier, younger enrollees.

Premium increases are projected to be around 15% for 2026, the steepest since 2018. The expiration of enhanced tax credits is expected to make the risk pool sicker as healthier individuals drop coverage due to cost.

Beyond the immediate 4.2 million losing coverage due to subsidy expirations, an additional 3.1 million are expected to lose coverage due to marketplace changes in the bill itself. Combined with other administrative changes, 8.2 million total marketplace enrollees are expected to become uninsured.

Medicaid System Transformation

7.8 million people will lose Medicaid coverage by 2034 due to the law’s work requirements with up to 13.7 million people losing coverage when including those who fail to navigate the complex reporting requirements.

States will face difficult choices as federal funding decreases. The bill has eliminated incentives for Medicaid expansion and reduces federal matching rates for states that cover immigrants with state funds. This will lead to further tightened eligibility requirements, or reduced provider payments.

Medicare’s Evolving Landscape

The bill failed to include permanent Medicare Economic Index adjustments, which provide increased payments to account for inflation. Without these increases, providers either do not recoup their cost, or they pass the cost on to the insured. Cost for those on Medicare will increase.

Healthcare System-Wide Consequences

Rural Healthcare

The bill’s impact on rural healthcare represents on of the it’s most severe long-term consequences. Independent rural hospitals could lose an estimated $465 million in total patient revenue in 2026 alone. This leaves the 380 independent rural hospitals nationwide at serious risk of closure.

Rural areas will be disproportionately affected, with states like Kentucky facing up to $28 billion in federal funding losses over the next decade and 35 rural hospitals at risk of closing. To put that number into perspective, Texas has 15 rural hospitals at risk, while New York has 11.

Provider Financial Stress

Healthcare providers across all settings face significant financial pressures from the combined impact of coverage losses and payment reductions.

Uncompensated Care Increases

Hospitals are projected to see a $63 billion increase in uncompensated care over 10 years, while physicians face $81 billion in Medicaid funding cuts and $24 billion in increased uncompensated care.

System-Wide Revenue Losses

Large health systems are already planning for substantial impacts. Providence Health System estimates up to $500 million in annual losses, while hospitals in Nassau County alone expect to close 3,000 jobs.

What can you do now to mitigate the effects of this bill?

Staying Covered for 2026 Marketplace Plans: A Practical Roadmap

Because the low-income special enrollment period is paused and enhanced subsidies end in 2025, the safest path the Marketplace coverage for 2026 is to enroll (or actively renew) during the only guaranteed window: November 1, 2025 through January 15, 2026. Missing that window means you must qualify for a traditional, documented SEP- and those will be harder to use in 2026.

Understanding the new calendar

Act Early- July → October 2025.

- Clear any past-due premiums. Insurance companies may now demand payment of both your first 2026 premium and any outstanding balance before issuing coverage.

- File your taxes and reconcile all outstanding APTCs. Beginning in 2026, a single missed tax-filing year will block premium tax credits.

- Estimate your 2026 income conservatively. Enhanced subsidies expire after 2025, so premiums will jump in 2026. Over-estimating income slightly can prevent a large repayment at tax time when caps vanish in 2026.

- Collect proof of possible SEPs. Documentation must now be uploaded before SEP enrollment is final. Employment termination letters, leases, marriage certificates, etc should all be on hand when signing up for coverage.

- Update your contact information with either the federal Marketplace or your state’s exchange so that you do not miss verification notices that now only allow 30-90 days for responses.

Navigate Open Enrollment Like a Pro

- Shop, don’t just renew. Plans change and Bronze/Catastrophic options becomes HSA-eligible in 2026, which may offset higher premiums.

- Compare Silver CSR plans if your income is under 250% of the FPL. They still offer lower deductibles after enhanced subsidies expire.

- Have your documentation ready. Not knowing where the social security cards are or not having copies of SEP verification paperwork are the two things I see the most. Make sure to keep these handy when you’re ready to enroll.

- Lock in by December 15 when possible. This will allow you to secure a January 1 start and beat potential website bottlenecks.

- Pay the first month’s premium right away! Coverage is not active until the insurance company receives payment.

If You Miss Open Enrollment

- Traditional SEPs do remain. Loss of employer coverage, marriage, childbirth/adoptions, and certain moves are the most common and all allow you enroll mid-year.

- Expect to upload documents right away. You will only have a limited time to have the documents submitted or your plan will not activate.

- Budget for a gap. Pre-enrollment verification can delay effective dates; consider short-term coverage or other health programs during any wait.

- Medicaid/CHIP check. These programs still allow year-round signup, but income limits and work verification requirements vary by state.

Prepare Financially for 2026 Premiums

- Set aside funds for higher net premiums. Loss of enhanced APTC plus the new $5 rule means very few truly free plans.

- Use an HSA if you choose a Bronze or Catastrophic plan; all such plans become HSA-compatible in 2026.

- Verify provider networks. Plans will most likely alter networks to manage cost in 2026.

Bottom Line

For 2026, mark November 1 through January 15 on your calendar, gather documents, pay outstanding premiums, and actively renew or enroll as soon as OE opens. Relying on automatic processes or the paused low-income SEP risks ending up uninsured once the stricter 2026 rules take effect.

For Medicaid Beneficiaries

Check and Update Your Eligibility

- Respond Quickly to State Notices. States will begin reviewing Medicaid eligibility every six months instead of annually. Make sure your mailing address, email, and phone number are up to date with your state Medicaid office, and open every letter you get from them.

- Gather Documentation. Keep recent pay stubs, benefits letters, proof of residency, and your identification documents in one place to respond quickly to any request for information.

Watch for Work Requirement Rules

- Prepare for Work Verification. If you’re between 19 and 64, new work requirements will affect your benefits by the end of 2026. You’ll need to show you’re working, in school, or involved in certain activities at least 80 hours per month.

- Ask About Exemptions. With the change in federal laws, the states may be changing their requirements also. Check with the local Medicaid office if you think you may have an exemption. Disabilities, being pregnant, or being a caregiver are common exemptions.

Plan for Cost-Sharing

- Budget for Copays. Starting in 2028, states can charge $35 per service for Medicaid enrollees. Consider setting aside a small amount each month for these payments.

For Medicare Beneficiaries

Review Your Plan Each Year

- Open Enrollment is Critical. Medicare’s annual enrollment period (October 15–December 7) is your chance to review or switch your plan. Compare options: if premiums or out-of-pocket costs increase, you may find a more affordable Part D drug plan or Medicare Advantage plan.

- Talk to a Broker. Take this opportunity to call us and review changes, as plans can alter cost-sharing, provider networks, or covered medications every year.

Understand Sequestration and Payment Changes

- Budget for Higher Cost. Automatic cuts in Medicare spending will result in higher coinsurance or fewer supplemental benefits.

- Look at Supplemental Coverage. If you don’t have one, consider a Medigap policy to help cover out-of-pocket costs—if you’re eligible—or review your Medicare Advantage plan for caps on annual spending.

Prescription Drug Savings

- Use the Extra Help Program. If you have limited income, you may qualify for “Extra Help,” which reduces prescription costs under Part D.

- Choose Generic Drugs. Ask your provider or pharmacist if lower-cost alternatives are available—this can save hundreds each year.

- Shop Pharmacies for Best Price. Different pharmacies may have different costs, and mail-order can sometimes be cheaper. You can read more about those options here.

Key Takeaways for Both Programs

- Actively monitor and respond to all official communications.

- Re-evaluate your health coverage and benefits annually.

- Seek out assistance programs for medications and services.

- Start budgeting for new or increased copays/coinsurance.

- Don’t hesitate to ask for help—even if I can’t help you directly, I can find someone that can.

By staying proactive and informed, you can minimize unexpected costs and maintain the coverage you need in the face of upcoming changes.

Sources

- https://www.healthinsurance.org/blog/new-federal-rule-brings-immediate-changes-to-marketplace-enrollment/

- https://www.forvismazars.us/forsights/2025/7/insights-from-the-new-aca-marketplace-integrity-final-rule

- https://www.kff.org/patient-consumer-protections/issue-brief/fraud-in-marketplace-enrollment-and-eligibility-five-things-to-know/

- https://www.healthcare.gov/quick-guide/dates-and-deadlines/

- https://blog.actionbenefits.com/cms-finalizes-off-cycle-aca-marketplace-rule-tightens-enrollment-and-subsidy-eligibility

- https://www.healthinsurance.org/special-enrollment-guide/an-sep-if-your-income-doesnt-exceed-150-of-the-federal-poverty-level/

- https://www.healthinsurance.org/special-enrollment-guide/an-sep-if-your-income-doesnt-exceed-150-of-the-federal-poverty-level/

- https://www.healthcare.gov/apply-and-enroll/health-insurance-grace-period/

- https://info.healthsherpa.com/aca-changes

- https://www.healthinsurance.org/blog/one-big-beautiful-bill-act-brings-sweeping-changes-to-health-coverage/

- https://www.cms.gov/newsroom/fact-sheets/2025-marketplace-integrity-and-affordability-proposed-rule

- https://www.cms.gov/newsroom/press-releases/cms-finalizes-major-rule-lower-individual-health-insurance-premiums-americans

- https://www.aamc.org/advocacy-policy/washington-highlights/cms-finalizes-rule-aca-marketplace-enrollment-and-eligibility

- The Real Cost of $0 Plans - September 9, 2025

- 2026 Update to Marketplace Insurance - September 2, 2025

- 2026 Updates for Medicare Beneficiaries - September 2, 2025